Introduction

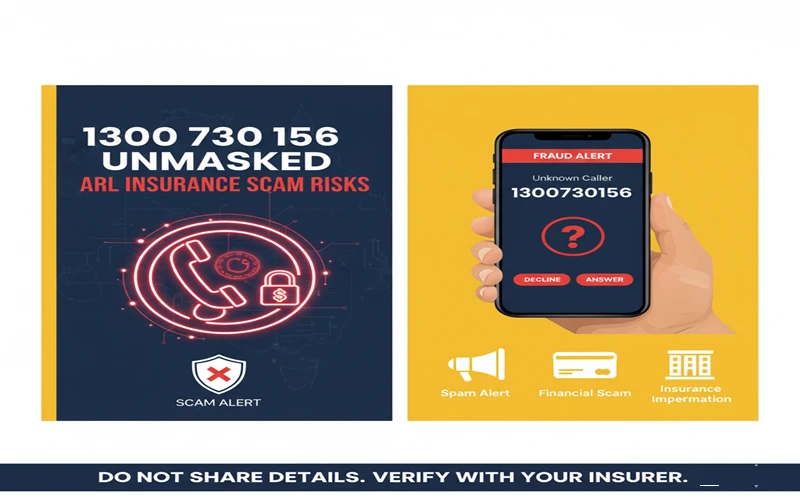

The 1300730156 number often appears in calls or texts linked to ARL debt collection, raising questions about whether it’s legit or part of an insurance scam. Many people receive urgent messages claiming unpaid debts from insurers like NRMA or RACV, directing them to dial 1300730156 for resolution. This article decodes these alerts, explaining how scammers impersonate legitimate agencies to extract money or personal info. We’ll cover red flags, verification steps, and protection tips based on user reports and official warnings. If you’ve been contacted, don’t panic—learn how to spot fraud and safeguard your finances. By the end, you’ll know how to handle such situations confidently.

What is 1300730156?

1300730156 is an Australian toll-free number associated with ARL Collect, a debt collection agency. ARL handles recoveries for various creditors, including insurers, but reports show it’s frequently misused in scams. Scammers call pretending to be from NRMA or other firms, urging you to contact this number for “urgent matters” like unpaid claims.

For example, you might get a text saying, “Contact ARL on 1300730156 regarding NRMA Insurance.” While ARL is real, fake callers exploit this to seem legitimate. Always verify independently—don’t call back directly. This number isn’t a standard customer care line; it’s for collections, which scammers twist for fraud.

Users report persistent harassment, even if they have no debts. Check official sites before responding. Internal link: See similar issues with IDFC Customer Care Number.

- Key Facts: Australian-based, linked to insurance recoveries.

- Risk Level: High if unsolicited.

Image suggestion: Phone with warning sign. Alt text: “1300730156 scam alert for verification”.

ARL Insurance and Debt Collection Basics

ARL stands for Australian Receivables Limited, a legitimate debt buyer and collector working with insurers. They pursue unpaid amounts from policies, accidents, or loans. However, “ARL Insurance” often misleads, as ARL isn’t an insurer but a collector for companies like NRMA.

In real scenarios, if you owe from a car accident claim, ARL might contact you legitimately. But scams fake this to pressure payments. Debt collection laws require validation of debts—ask for proof in writing.

Many confuse ARL with insurance providers, leading to vulnerability. External link: Learn more from Australian Securities and Investments Commission (ASIC). Always confirm debts through original creditors.

Table: Legit vs. Scam Debt Collection

| Aspect | Legitimate | Scam |

|---|---|---|

| Contact Method | Written notice first | Unsolicited calls/texts |

| Debt Proof | Provides details | Vague threats |

| Payment Demand | No immediate wire/gift cards | Urgent, unusual methods |

Signs That 1300730156 Calls Are Scams

Spotting scams from 1300730156 starts with unsolicited contacts claiming debts you don’t recall. Scammers impersonate NRMA or RACV, saying you owe for claims or policies.

Red flags include threats of legal action without proof, demands for immediate payment via untraceable methods, or requests for personal info over the phone. If the caller pressures you or won’t provide written validation, hang up.

For instance, texts urge calling 1300730156 for “escalation,” but legit collectors send letters first. No legitimate entity asks for bank details upfront. Internal link: Compare with 8773867049 scams.

- Warning Signs: Unknown debts, aggressive tone, no documentation.

- User Tip: Record calls for evidence.

Common ARL Insurance Scam Tactics

Scammers using 1300730156 often pose as debt collectors for insurance firms, claiming unpaid premiums or accident damages. They send texts linking to fake sites or direct calls, aiming to phish data.

One tactic: Pretend you’re liable for another’s claim, demanding payment to avoid court. Another: Fake NRMA referrals to ARL for “verification.” They create urgency, saying “last chance” to pay.

These align with broader imposter scams, where fraudsters mimic trusted brands. Protect by verifying with the insurer directly. Examples from forums show victims nearly paying thousands.

Image suggestion: Fake text message example. Alt text: “1300730156 scam text impersonating insurance”.

How Scammers Impersonate Legitimate Services

Impersonation is key in 1300730156 scams—callers spoof caller ID to appear from insurers. They reference real companies like NRMA to build trust, then route to fake collectors.

Tactics include robocalls or texts with partial personal info, harvested from data breaches. Once engaged, they demand payments for non-existent debts, using fear of lawsuits.

Official warnings note this mirrors global imposter frauds. Always use known contacts from official websites, not provided numbers.

- Methods: Spoofing, data leaks, urgent threats.

- Prevention: Independent verification.

Real User Experiences with 1300730156

Users report receiving texts from 1300730156 claiming RACV debts despite no policy. One shared: “Called pretending NRMA issue, wanted payment over phone—scam!”

In forums, victims describe harassment for PayPal or insurance “debts” they never had. Another: “Shocked by $19k claim; turned out fake after checking with insurer.”

These stories highlight emotional toll—fear, stress. Many advise ignoring and reporting. External link: Report to Scamwatch Australia.

Steps to Verify if 1300730156 is Legit

To check 1300730156 legitimacy, don’t call it—contact the alleged creditor directly via official channels. Search ASIC or company sites for ARL confirmation.

Request debt validation in writing; legit collectors must provide it. Use reverse lookup tools cautiously, as scammers spoof numbers.

If suspicious, freeze credit and monitor accounts. Internal link: Similar verification for HDFC Customer Care.

Table: Verification Checklist

| Step | Action |

|---|---|

| 1 | Contact original creditor |

| 2 | Demand written proof |

| 3 | Check official registries |

| 4 | Report if fishy |

Protecting Yourself from Debt Collection Scams

Shield against 1300730156 scams by never sharing info over unsolicited calls. Use call-blocking apps and verify debts independently.

Educate family, especially elderly, on tactics. Monitor credit reports regularly for unauthorized activity.

Secure personal data—strong passwords, two-factor authentication. If scammed, report immediately to minimize damage.

- Tips: Block numbers, use official apps.

- Long-term: Credit monitoring services.

What to Do If You Receive a Suspicious Call

Hang up on 1300730156 calls demanding payment without proof. Don’t engage—scammers thrive on response.

Document everything: number, time, details. Contact your insurer or bank to confirm no debt.

If info was shared, change passwords and alert credit bureaus. Seek free counseling from consumer protection agencies.

Image suggestion: Flowchart for handling calls. Alt text: “Steps to handle 1300730156 scam calls”.

Reporting 1300730156 Scams

Report 1300730156 suspicions to Scamwatch or ACCC in Australia. Provide call logs and texts as evidence.

For US parallels, use FTC or IC3. Reporting helps track and stop scammers.

Local police for threats. External link: FTC Scam Reporting.

Alternatives to Calling Unknown Numbers

Instead of dialing 1300730156, use verified customer care lines from official sites. For insurance, contact NRMA directly.

Apps and online portals for debt checks are safer—no phone risks. Consult financial advisors for legit debts.

- Safe Options: Official websites, certified mail.

- Avoid: Unsolicited links or numbers.

Conclusion

In decoding 1300730156 and ARL Insurance scam alerts, remember it’s often a tool for impersonation fraud, not legit customer care. Key signs include unsolicited demands and lack of proof—always verify independently to avoid losses. We’ve outlined verification steps, reporting, and protections to keep you safe. Share your story in comments if affected, and check related guides like SBI Customer Care. Stay vigilant, report suspicious activity, and protect your finances confidently.

FAQ

Is 1300730156 a legitimate customer care number?

No, 1300730156 is linked to ARL collections but often used in scams impersonating insurers. Verify debts directly with creditors.

What should I do if I get a call from 1300730156 about insurance?

Hang up and contact the insurer using official numbers. Demand written debt proof if legit.

How do ARL Insurance scams work?

Scammers pose as collectors for unpaid claims, pressuring quick payments via untraceable methods.

Can I ignore texts from 1300730156?

Yes, if unsolicited—report them instead of responding to avoid phishing.

Where to report 1300730156 scam attempts?

Use Scamwatch Australia or FTC for international; provide details for investigation.

Visit Also: 6042101411 Scam Alert